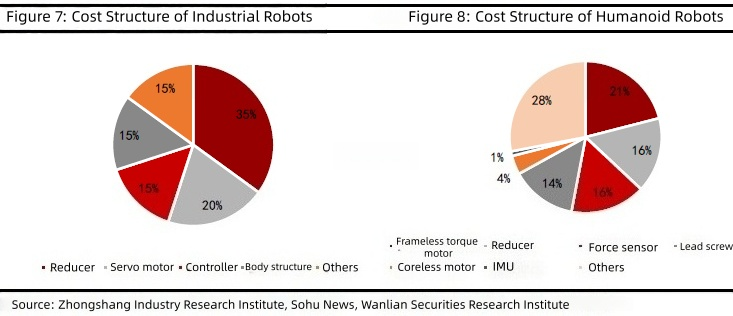

Precision reducers are the core components of robots, accounting for a significant portion of the cost structure in both industrial and humanoid robots. Their performance directly determines the overall performance of the robot, making quality and performance the primary considerations during selection. Reducers represent a substantial portion of a robot’s total cost. According to data from the China Business Industry Research Institute, they account for 35% of industrial robot costs, making them the highest-cost component. Data from Zhiyan Consulting shows they make up 16% of humanoid robot costs, second only to frameless torque motors, positioning them as a key component in humanoid robots. Despite the downward trend in reducer prices driven by technological advancements and intensified market competition, they remain a crucial part of robot costs. Global reducer manufacturers are continuously driving cost reductions through technological innovation and scaled production.

2.1 Harmonic Reducer: Robot is the core incremental market, Green Harmonic Achieve Breakthrough

The harmonic reducer consists of three key components: a wave generator, a flexible wheel, and a rigid wheel. Through their coordinated operation, this device achieves high reduction ratios and torque output in a compact design. The wave generator drives the rigid wheel’s rotation via the flexible wheel’s elastic deformation, effectively reducing speed while increasing torque. This design makes it particularly suitable for precision control applications and space-constrained environments.

China’s harmonic reducer market is experiencing rapid expansion. These precision-driven components are widely used in precision transmission systems, with applications now extending to robotics, high-end CNC machine tools, semiconductor manufacturing, and medical equipment. Data from the China Business Industry Research Institute shows the market size grew from 1.35 billion yuan in 2019 to 2.49 billion yuan in 2023, achieving a robust 16.54% compound annual growth rate (CAGR). The market is projected to reach 3.32 billion yuan by 2025, with a CAGR of 15.47% during the 2023-2025 period.

The global harmonic reducer market exhibits a “dominant leader” structure, with Lüde Harmonic achieving breakthroughs in domestic production. The competitive landscape remains

highly concentrated, with Japanese manufacturer Harmonic Drive holding a leading position with over 80% global sales market share. In China’s 2023 harmonic reducer market, Harmonic Drive and Lüde Harmonic ranked in the first tier, capturing 38.7% and 14.5% of sales market share respectively. Companies like Lai Fu Harmonic, Tongchuan Technology, and Japan’s Shinboshi Technology formed the second tier, holding 9.2%,7.3%, and 6.7% market shares. Technologically, Harmonic Drive maintains industry leadership, while domestic manufacturers like Lüde Harmonic have achieved international advanced levels through technological breakthroughs and production process improvements in reduction ratios, rated torque, transmission efficiency, and precision. This progress has broken foreign manufacturers’ technological monopoly in high-end harmonic reducers, gradually replacing imported brands.

Chart 13: Basic Information of Major Domestic & Overseas Harmonic Reducer Manufacturers

Company Name

Registration Location Main Registration Location Main

Product Categories

Application Fields

Harmonic Drive Systems Inc. (HDSI)

Japan

Harmonic reducers,planetary reducers,actuators,servo drives, etc.

Industrial robot field (represented by multi-joint robots), medical equipment, optical measuring instruments, communication equipment, printing equipment, as well as deep-sea robots, aerospace development, etc.

NIDEC (Japan)

Japan

Motors, fans, blowers, motor controllers, reducers, conveyors, optical equipment, sensors, electronic devices, equipment fixtures, production equipment, etc.

Automotive, home appliances, consumer electronics, robots, logistics, medical & health care, public facilities (transportation, energy, ICT), commerce, entertainment, industry, etc.

Green Harmonic

Suzhou,Jiangsu (China)

Harmonic reducers & metal components, motor-integrated products, hydraulic products

High-end manufacturing fields such as industrial robots, service robots, CNC machine tools, medical devices, semiconductor production equipment, new energy equipment, etc.

Laifubo

Shaoxing,Zhejiang (China)

Harmonic reducers

Industrial robots, service robots, medical equipment, high-precision automation equipment, etc.

2.2 RV Reducer: Japanese Companies Lead the Market, Domestic Substitution Potential Huge

The RV reducer employs a two-stage reduction mechanism, combining a first-stage involute planetary transmission with a second-stage cycloidal planetary transmission. This design delivers exceptional advantages including a wide transmission range and high efficiency. Featuring robust load-bearing capacity and superior rigidity, it serves as an ideal high-performance transmission system, particularly suited for industrial robots, CNC machine tools, and medical diagnostic equipment where transmission efficiency, load-bearing capacity, and precision are critical requirements.

The RV reducer market continues to expand, with China’s market growth rate exceeding the global average. Both the global and China RV reducer markets are showing steady growth, primarily driven by the rapid development of industrial automation and smart manufacturing, especially the widespread application in the field of industrial robots. According to QY Research data, the global RV reducer market size grew from 3.43 billion yuan to 7.51 billion yuan from 2018 to 2023, with a CAGR of 16.97%. According to data from Huajing Industry Research Institute, the China RV reducer market size increased from 1.082 billion yuan to 4.295 billion yuan from 2014 to 2021, with a CAGR of 21.77%, outpacing the global average growth rate. It is projected that the market size will reach 6 billion yuan by 2025. Among these, the high growth rate of China’s RV reducer market from 2014 to 2017 was mainly attributed to the rapid increase in downstream industrial robot installations; the slowdown in industrial robot installation growth from 2018 to 2019 led to stagnation in the RV reducer market size growth; and the renewed acceleration in industrial robot installations from 2020 to 2021 drove a significant surge in RV reducer demand.

Nabtesco maintains a dominant position in the RV reducer market, with domestic substitution efforts gaining significant momentum. In the global RV reducer sector, Japanese manufacturer Nabtesco has consistently held industry leadership. Domestically, Nabtesco dominated the market in 2020 with an absolute 54.80% market share, followed by Sumitomo Heavy Industries (6.60%) and Zhongda Lide (6.16%). From 2021 to 2023, the market landscape underwent notable changes as Huandong Technology demonstrated strong growth, increasing its market share from 5.25% in 2020 to 18.89% in 2023, securing its position as China’s second-largest player. Meanwhile, international manufacturers saw their market shares shrink, with Nabtesco’s share declining from 54.80% to 40.17%. As Huandong Technology progressively replaces Nabtesco’s imports, it has further solidified its leadership in China’s robotic RV reducer market.