(1) The successive introduction of national strategies and industrial policies has driven the rapid development of domestic precision reducers.

In recent years, industrial policies have provided strong support for technological breakthroughs and accelerated development in industrial robots and precision reducers. The government has designated robotics and high-end CNC machine tools as one of the ten key priority areas requiring vigorous promotion, with specific requirements to achieve engineering breakthroughs and industrialization of intelligent core components like reducers. The 14th Five-Year Plan and its supporting plans outline strategies to deepen the manufacturing power strategy, optimize and upgrade the manufacturing sector, cultivate advanced manufacturing clusters, and drive innovation in industries such as robotics. The plan emphasizes the development of intelligent manufacturing equipment, addressing weaknesses in perception, control, decision-making, and execution through industry-academia-research collaboration. Key objectives include overcoming critical bottlenecks in foundational components and devices, as well as developing advanced controllers, high-precision servo drive systems, and high-performance, high-reliability reducers.

For instance, the “14th Five-Year Plan for Robot Industry Development” outlines that in the face of new circumstances and requirements, the next five years and beyond will be a strategic opportunity period for China’s robotics industry to achieve self-reliance, innovation, and leapfrog development. It emphasizes seizing opportunities, confronting challenges, and accelerating solutions to issues such as insufficient technological accumulation, weak industrial foundations, and lack of high-end supply, thereby propelling the robotics industry toward mid-to-high-end development. The plan advocates for high-end and intelligent development, targeting industrial transformation and consumption upgrades. Key priorities include breaking through core technologies, consolidating industrial foundations, enhancing effective supply, expanding market applications, improving supply chain stability and competitiveness, continuously refining the industrial ecosystem, and driving high-quality growth in the robotics sector. The development goals set forth in the plan are: By 2025, China aims to become a global hub for robotics innovation, a cluster for high-end manufacturing, and a new frontier for integrated applications. Breakthroughs will be achieved in core robotics technologies and premium products, with overall performance metrics reaching international advanced levels and key components matching the reliability of global counterparts. The robotics industry’s annual revenue growth rate will exceed 20%, fostering a group of internationally competitive leading enterprises and numerous innovative, high-growth specialized “little giant” enterprises. Three to five globally influential industrial clusters will be established. Manufacturing robot density will double. By 2035, China’s robotics industry will achieve world-leading comprehensive strength, with robots becoming integral components of economic development, people’s livelihoods, and social governance. The plan outlines key objectives: strengthening industrial foundations, enhancing the functionality, performance, and reliability of critical robot components, and developing advanced manufacturing technologies for high-performance reducers, including RV reducers and harmonic reducers. These efforts will improve precision retention (longer lifespan), reliability, and noise reduction, paving the way for mass production.

The successive rollout of national and industrial policies has provided strong support for the rapid development of domestic precision reducers.

(2)Benefiting from the growing demand for industrial robots, the market for industrial robot reducers, including RV reducers, is expanding rapidly.

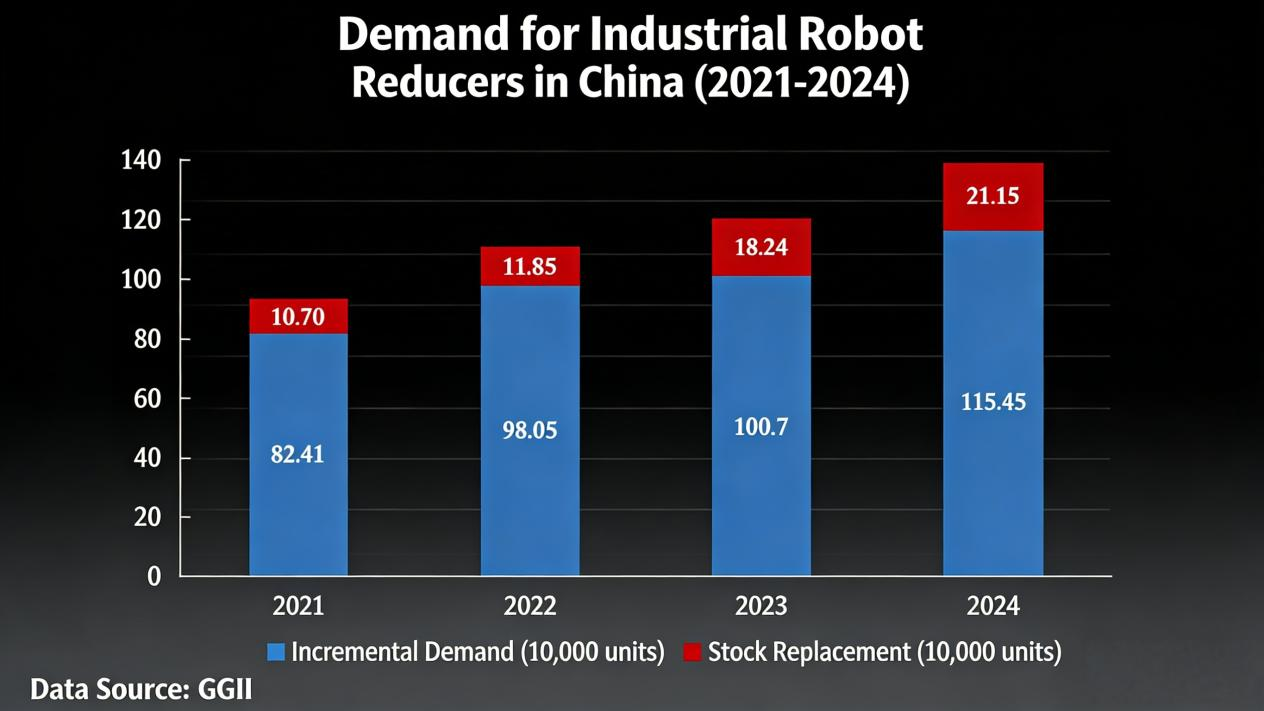

According to GGII data, China’s total demand for industrial robot reducers increased from 931,100 units to 1,366,000 units between 2021 and 2024, with a compound annual growth rate (CAGR) of 13.63%. The incremental demand rose from 824,100 units to 1,154,500 units, achieving a CAGR of 11.89%. As digitalization accelerates, the automation of human labor will gain significant benefits. As a core component driving industrial automation, supporting industrial upgrading and smart manufacturing, reducers are poised for long-term growth.

(3) The Rise of Domestic Brands in Industrial Robots and RV Reducers

In recent years, driven by surging downstream demand, expanding application fields, and bolstered by industrial policies and collaborative efforts among government, industry, academia, research institutions, and end-users, China’s industrial robotics sector has prioritized breakthroughs in core technologies. Domestic manufacturers have consistently overcome technical hurdles in critical components like gearboxes, steadily enhancing their technological prowess and competitive edge. The performance gap between Chinese products and global leaders continues to narrow.

In China’s industrial robot market, domestic brands are rapidly rising, and the import substitution process is accelerating. With breakthroughs in key technologies, improvements in the performance of domestic robots, and the optimization of the supply chain system, domestic industrial robot manufacturers have seized market opportunities to achieve rapid growth in recent years.

Meanwhile, China’s industrial robot reducer industry, including RV reducers, has entered a phase of rapid growth. With domestic RV reducer manufacturers enhancing their technical capabilities and product performance, gradually expanding production capacity, and gaining increasingly prominent pricing and cost-performance advantages, leading domestic industrial robot manufacturers are rapidly increasing the localization rate of RV reducers in procurement. This trend is driven by considerations such as supply chain security and stability, procurement costs, and procurement cycles. The domestic industrial robot reducer market demonstrates significant growth potential and vast market space.