1.Relevance to the upstream industry

The primary raw materials for RV reducers include externally sourced components such as bearings, blanks, steel, and cutting tools. The upstream supply chains for bearings, blanks, and steel are predominantly sourced from the steel industry, where market supply remains abundant and competition is intense. Both product quality and supply conditions meet industry demands. In recent years, steel prices have remained relatively stable due to supply-side reforms and overcapacity reduction efforts in the steel sector. However, fluctuations in steel prices—driven by factors like international commodity market trends—may affect the raw material costs and profit margins of reducer products. From a long-term perspective, China’s ample steel supply is unlikely to adversely impact the RV reducer industry.

Relevance to Downstream Industries

As an indispensable component in high-precision equipment, RV reducers are extensively utilized in advanced manufacturing sectors like robotics and industrial automation. Their product quality, reliability, and service life directly determine the performance of host systems, while the industry’s scale and development trends are driven by downstream market demands. In recent years, with the introduction of supportive policies such as the “14th Five-Year Plan for the General Machinery Parts Industry” and the “14th Five-Year Plan for Robot Industry Development,” high-end equipment manufacturing—represented by industrial robots and high-end CNC machine tools—has become a key focus for national development to achieve breakthroughs. Meanwhile, the accelerated industrial restructuring and upgrading have spurred continuous advancements in industrial automation and intelligentization. Benefiting from downstream industry momentum, the RV reducer sector is poised to enter a new phase of rapid growth.

Industry competition landscape

In the context of Industry 4.0, developed countries represented by Japan have prioritized advancing the robotics industry. They have achieved complete self-sufficiency in core components like RV reducers and secured significant market share through technological leadership. The RV reducer industry is characterized by high technical complexity, substantial investment thresholds, and stringent industry barriers. It requires substantial capital and talent investment in R&D design, quality control, and product testing. Manufacturing processes demand strict requirements for materials, production equipment, and process precision, making large-scale production challenging. Globally, few manufacturers can reliably supply mass-produced RV reducers with reliable performance. Leveraging their long history, strong capital base, and extensive technical expertise, Japanese companies dominate the global industrial robot reducer market. Notable representatives include Nabtesco, which has established a prominent position through cutting-edge R&D capabilities, large-scale production capacity, consistent product quality, and long-standing collaborations with international industry leaders like FANUC and KUKA.

Due to the late start of China’s RV reducer industry, the overall technical level of enterprises in the industry still lags behind that of internationally leading companies. In the domestic RV reducer market, as domestic manufacturers continuously overcome technical challenges, their technical capabilities and competitiveness have steadily improved, narrowing the gap between product performance and the leading levels abroad. According to the “China Robot Industry Development Report (2022)” by the China Electronics Society, the core competitiveness of key components in China’s industrial robots continues to rise. Taking reducers as an example, a group of outstanding enterprises such as Lüde Harmonic (mainly focusing on harmonic reducers) and Huandong Technology (mainly focusing on RV reducers) have become pioneers in leading the development of the domestic reducer market, thanks to their sustained R&D investment, high precision manufacturing capabilities, strict quality control, and continuously improving product systems.

Major companies in the industry

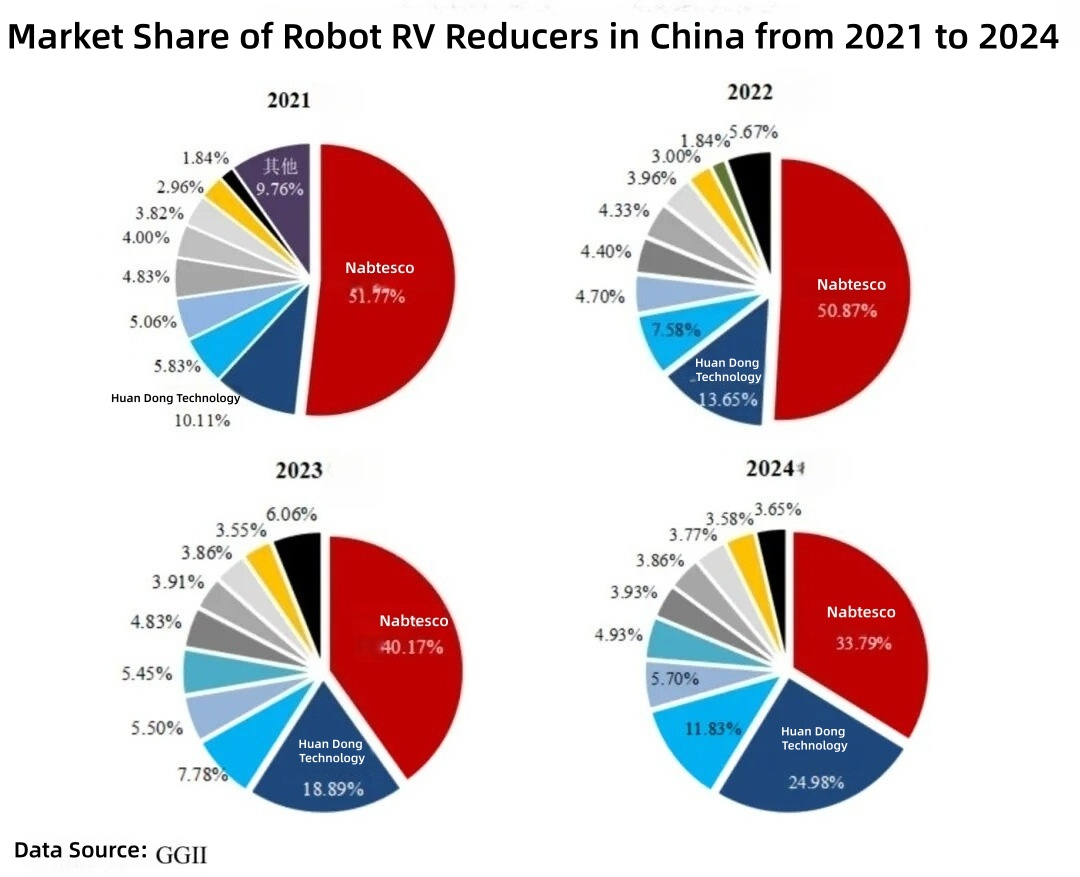

Globally, Nabtesco is the market leader in the RV reducer industry. In China’s RV reducer market, besides Nabtesco, Huandong Technology has gained a leading position with a market share approaching 20%, while other companies are relatively smaller. The basic situation is as follows:

corporate name

Headquarters location

Key business operations and market position

Nabtesco

Japan

As the creator of RV reducers and a leading enterprise in the field of motion control, it is the world’s largest manufacturer of robotic RV reducers. According to GGII statistics, its market share in China’s robotic RV reducers was 50.87%,40.17%, and 33.79% in 2022,2023, and 2024 respectively.

Circulation Technology

China

The main product, RV reducer, has basically covered leading domestic robot customers, with strong production and processing capabilities, enjoying high brand awareness in the industry. It has become a professional manufacturer of RV reducers for industrial robots with leading domestic production and sales volume. According to GGII statistics, its market share in China’s robot RV reducer market was 13.65%,18.89%, and 24.98% in 2022,2023, and 2024 respectively.

Source: publicly available data, GGII

In recent years, Shuanghuan Technology has achieved rapid market expansion and established dominance in China’s robotics sector through its RV reducers. In 2020, Nabtesco dominated the domestic RV reducer market with 54.80% share, while Sumitomo Heavy Industries held 6.60% and Shuanghuan Technology only 5.25%. From 2021 to 2024, Shuanghuan Technology’s market share rose steadily to 10.11%,13.65%,18.89%, and 24.98%, consistently ranking second only to Nabtesco. During the same period, Nabtesco’s market share declined to 51.77%,50.87%,40.17%, and 33.79%, while Sumitomo Heavy Industries saw its share drop to 5.06%,4.70%,3.91%, and 3.58%. This sustained decline in international competitors’ market share highlights Shuanghuan Technology’s role as a leading domestic alternative to Nabtesco’s products. By progressively replacing imported Nabtesco components, Shuanghuan Technology has solidified its position as the industry leader in China’s robotics RV reducer market.

[Disclaimer]This excerpt is from Shuanghuan Technology’s prospectus. All rights reserved by the original author. For knowledge sharing and communication purposes only, not for commercial use. We maintain neutrality regarding all viewpoints expressed herein. Should you find any discrepancies between the cited sources and facts, or if there are copyright-related issues, please notify us for prompt revision or removal.