Development Status and Challenges of Transmission Assembly

As a power transmission system in electric drive, the reducer can reduce speed and increase torque to meet the normal power demand of users. It mainly includes gear system, bearing, differential, housing and other accessories. The key attributes and performance requirements are space size, weight, efficiency and NVH.

Current electric drive reducers predominantly feature a single-speed, two-stage parallel shaft design, which offers a simple structure and high cost-effectiveness, making it the undisputed mainstream solution. However, as users increasingly demand more space and range in vehicles, the pressure on various subsystems grows significantly. As a critical component, electric drive reducers now face substantial challenges in space, weight, and efficiency. Leading OEMs and international powertrain giants are actively exploring innovative architectures, such as planetary gear arrangements.

Currently, planetary gear mass-production models are predominantly found in mid-to-high-end vehicles from international brands like Audi e-tron, Jaguar Land Rover I-Pace, and Lucid Air. In China, only the Jike brand and select Geely models will adopt this technology starting in 2024. Meanwhile, the passenger car planetary gear supply chain market is almost entirely dominated by global giants such as Schaeffler and ZF. Domestic manufacturers like Xingqu are actively expanding their presence in this field. Moving forward, coaxial planetary gears are expected to gain significant market traction, particularly in mid-to-high-end vehicle segments.

The requirement for high compactness in transmission systems

▶ present situation

As a key powertrain component, the electric drive greatly affects the vehicle layout. With the increasing demand of the public for the interior space and luggage compartment space, and the platformization of the vehicle and powertrain, the powertrain is required to have a high adaptability to the vehicle layout.

Therefore, the space and regularity of the electric drive are required to be higher. As shown in the figure below, the size of the transmission system directly affects the X direction (longitudinal direction of the vehicle) of the electric drive, and then affects the space in the car or the space in the luggage compartment.

Figure 1 Schematic diagram of transmission system layout Source: Public information

The current transmission system predominantly employs parallel shaft configurations, where the X-axis dimensions are directly influenced by the distance between the input and output shafts. Industry standards for X-axis dimensions are generally as outlined in the table below. Although planetary gearboxes currently hold a small market share, their demand is projected to grow significantly in the future. Schaeffler, a leading advocate of planetary gearboxes, has developed models with X-axis dimensions 30% to 40% smaller than traditional parallel shaft systems.

Table 1 X dimensions in the industry

torque output

<3000Nm

3000-4000Nm

4000-5000Nm

X-axis dimension

<400mm

400-600mm

460-480mm

▶ throw down the gauntlet

The current transmission system compresses the space to the extreme. After reducing the center distance, it faces risks of shaft-to-tooth strength and NVH (Noise, Vibration, and Harshness).

The reduced center distance imposes constraints on macroscopic parameters of the gear teeth, including module limitations, root bending risks, and tooth surface contact strength challenges. Furthermore, the heightened torque response and frequent regenerative braking demands in new energy vehicles impose stricter strength requirements on gear teeth and differentials. Optimization is required in material selection, heat treatment processes, and surface strengthening techniques.

The need for lightweight transmission systems

▶ present situation

For new energy vehicles, particularly pure electric models, range is a key concern for users, while weight significantly impacts driving range. The electric drive accounts for approximately 5% of the total vehicle weight, with the transmission system making up about 50% of the electric drive’s weight. Since the transmission system’s weight directly affects both cost and dimensions, low weight is also a critical requirement for the electric drive.

Currently, parallel shaft reducers dominate the market with over 95% adoption, where weight correlates with output torque as shown in the table below. The Zhi Ji L7/L6 series features magnesium-aluminum alloy housings, achieving 30% lighter weight than conventional aluminum alloy housings. Although planetary gearboxes currently hold a small market share, their demand is projected to grow significantly. As a pioneer in planetary gear reducer technology, Schaeffler’s solutions reduce weight by 30% to 40% compared to traditional parallel shaft reducers.

Table 2 Relationship between weight and output torque of single reducer

torque output

<3000Nm

3000-4000Nm

4000-5000Nm

Weight (dry weight)

<25kg

25-30kg

30-35kg

▶ throw down the gauntlet

To meet the demand for lightweight transmission systems, reducers are typically optimized through structural design and material selection. Structural optimization directly reduces material usage, but this approach also introduces risks of strength and reliability, as well as NVH (Noise, Vibration, and Harshness) issues. While magnesium-aluminum alloy housings are cost-effective, they suffer from high-temperature creep and poor stiffness, which further exacerbates NVH risks.

The need for efficient transmission

▶ present situation

Another critical factor affecting vehicle range is electric drive efficiency. Beyond CLTC (China’s New Energy Vehicle Testing and Certification) standards, high-speed constant-speed efficiency has become a key concern for users. Common high-speed driving conditions like 100 km/h and 120 km/h require high-efficiency high-speed transmission systems with low torque output. Key considerations include transmission architecture, shaft layout, bearing selection, gear precision, housing cavity design, and lubricant choice.

With OEMs adopting assembly applications, refined operational conditions, and advancements in component technologies, the CLTC efficiency of gearboxes has been steadily improving. Before 2020, the CLTC efficiency was generally around 97%, with some manufacturers achieving 97.5%. For instance, XPeng Motors’ G9 (2022 model) demonstrated a measured CLTC efficiency exceeding 97.5%, while the G6 (2023 model) reached 97.6%.

▶ throw down the gauntlet

At present, the high efficiency reducer is basically through reducing the torque loss and reducing the speed loss.

Reduce torque loss by improving gear meshing precision, reducing tooth surface roughness and slip rate, and using low rolling resistance ball bearings.

Reducing speed loss: The dry oil pan minimizes oil agitation loss, and low-viscosity lubricants are recommended.

The high meshing precision and low tooth surface roughness will put forward higher requirements for the shaft gear machining technology and production rhythm, and also mean higher production cost. The protection ability of the shaft gear bearing will be reduced when low viscosity lubricating oil is selected, which brings higher challenge to the reliability of the shaft gear bearing.

The need for low-noise transmission

▶ present situation

As consumers increasingly prioritize vehicle quietness, the lack of engine noise masking in electric drive systems makes their noise more noticeable. Moreover, the noise from electric drive gearboxes typically falls within the mid-to-high frequency range that users can easily perceive. With recent advancements in domestic vehicle manufacturing processes and material quality, the overall sound quality of vehicles has significantly improved, which has further accentuated the whistling noise from electric drive systems.

In modern drivetrain systems, NVH issues have expanded beyond shaft-to-tooth squealing. Customers now prioritize ride comfort and acoustic quality, while also noticing clunking noises and jerky transitions during torque shifts. This reflects the growing complexity of NVH challenges in automotive engineering.

In standard transmission systems, the semi-damp chamber typically produces an average noise level of 5 decibels (dB) at 1 meter distance and around 70dB(A) under full torque conditions, with some manufacturers achieving noise levels below 65dB(A).

▶ throw down the gauntlet

Compared to conventional vehicles, new energy vehicles face greater NVH (Noise, Vibration, and Harshness) development challenges due to the absence of the masking effect from internal combustion engines and users’ growing demand for cabin quietness. The transmission system noise in these vehicles predominantly involves mid-to-high frequency sounds that are particularly sensitive to human ears. With numerous rotating components and significant challenges in mass production and assembly stability, transmission noise has become a major source of customer complaints.

NVH (Noise, Vibration, and Harshness) is a subjective perception closely tied to cost considerations. As user expectations vary across different vehicle segments, establishing NVH development objectives must first align with the vehicle’s positioning and target user demographics. The resolution of NVH issues spans the entire vehicle development lifecycle. Once identified, the process involves testing, analysis, computational simulations, problem categorization, solution formulation, and validation. Beyond a robust development process, hands-on experience plays a pivotal role in addressing these challenges.

To address transmission system squealing, structural excitation is the root cause, while path control is equally critical. NVH improvement strategies targeting both source and path often conflict with lightweighting requirements while driving up costs. Beyond the inherent complexity and evolving demands of NVH challenges, achieving multidimensional balance between NVH mitigation measures, lightweighting, and cost control poses a significant decision-making challenge for OEMs and suppliers at all levels.

The Development Status and Challenge of Gear

1.The high-speed rotation requirement of gears

▶ present situation

High-speed gears have been widely adopted in new energy vehicles, primarily for their ability to transmit power stably at high speeds. Their application involves multiple aspects including material selection, design, manufacturing, and lubrication. The gear speed in new energy vehicles has evolved from 12,000 rpm to over 20,000 rpm, and is now trending toward 30,000 rpm and beyond.

The development of high-speed gears has raised higher requirements for gear design, material selection, and manufacturing, especially in terms of controlling gear lifespan, lubrication, heat dissipation, and NVH (Noise, Vibration, and Harshness).

▶ throw down the gauntlet

Reliability: High-speed operation accelerates tooth surface contact fatigue, fretting fatigue, and stress concentration, leading to premature gear failure. Currently, materials such as 20MnCr5 are selected for gears, which offer higher strength, better toughness, and superior heat treatment and processability.

Lubrication & Heat Dissipation: At high rotational speeds, gears experience higher linear velocities, resulting in increased heat generation during meshing and hindering oil film formation, thereby elevating the risk of gear failure. This also poses greater challenges in gear design, requiring stricter specifications for anti-caking properties, slip rates, and linear velocities. A well-designed tooth profile is particularly critical, while the selection of lubricants and proactive lubrication of gears are equally vital.

Dynamic balancing: As the rotational speed increases, the impact of dynamic balancing factors on the NVH of electric drives gradually intensifies, and the dynamic balancing requirements for shaft-to-tooth components become more stringent. Currently, all shaft-to-tooth components now include dynamic balancing inspection requirements.

Gear NVH: The expanded torque, speed, and rotational frequency ranges at high gear speeds significantly increase NVH control complexity. This raises challenges in managing gear excitation and vehicle transmission paths, requiring coordinated design of both electric drive sound packages and vehicle sound packages, along with vibration and noise isolation for structural pathways. At higher speeds, the torque and speed ranges broaden considerably, while the corresponding rotational frequency range nearly doubles, substantially complicating NVH control. As a result, acoustic packages have become a standard feature in electric drive systems.

Gear manufacturing: The precision requirements for gears are becoming increasingly stringent. Currently, the industry is transitioning from the national standard grades 5-6 to grades 5 and above, making the manufacturing process more challenging.

The requirement for high gear ratios

▶ present situation

With the development of motor performance, the peak speed of motor is gradually increased, the limit of the maximum speed is gradually improved, and the limit of the gear ratio is gradually released.

Considering the vehicle acceleration and electric drive economy, increasing the speed ratio can quickly improve the wheel-end torque of the vehicle, and reduce the volume of the motor to achieve the economic index.

As the peak speed of the motor approaches 20,000+, the gear ratio is also showing a gradual increasing trend. For example, Huichuan has mass production projects with a gear ratio> 12, and Huawei has mass production projects with a gear ratio> 13. Designs with gear ratios above 13 are gradually becoming the norm.

▶ throw down the gauntlet

The application of high-speed ratio gears has increased the difficulty in both gear performance and manufacturing.

NVH performance: High-speed ratio gears typically generate more noise and vibration, and their design, material selection, and manufacturing pose greater technical challenges.

In terms of reliability, high speed ratio gear needs to bear larger torque and speed, and the linear speed of gear meshing is also larger, which puts forward more strict requirements on the reliability index of bending and contact.

Material: With the increase of the speed and torque, the performance of the gear material is also required to be higher, which needs to consider the strength and wear resistance.

In the manufacturing, the high speed ratio gear is more sensitive to the gear meshing excitation, which makes the gear require higher precision and consistency.

High NVH requirements for gears

▶ present situation

Unlike internal combustion engines, new energy vehicles are more sensitive to gear NVH performance, requiring higher NVH standards for gear systems, particularly in terms of transmission smoothness and noise reduction.

Gears are a key power source in electric drive systems. Given their lengthy manufacturing processes and high control complexity, NVH (Noise, Vibration, and Harshness) issues in gears pose a significant challenge for the industry. Industry statistics indicate that 70-80% of aftermarket NVH problems stem from bearings and gears, with gear-related issues accounting for 50-60%. Gear NVH is a major contributor to overall vehicle NVH performance. As high-speed and high-ratio gears become increasingly prevalent, addressing NVH challenges in gears has emerged as the industry’s top priority.

▶ throw down the gauntlet

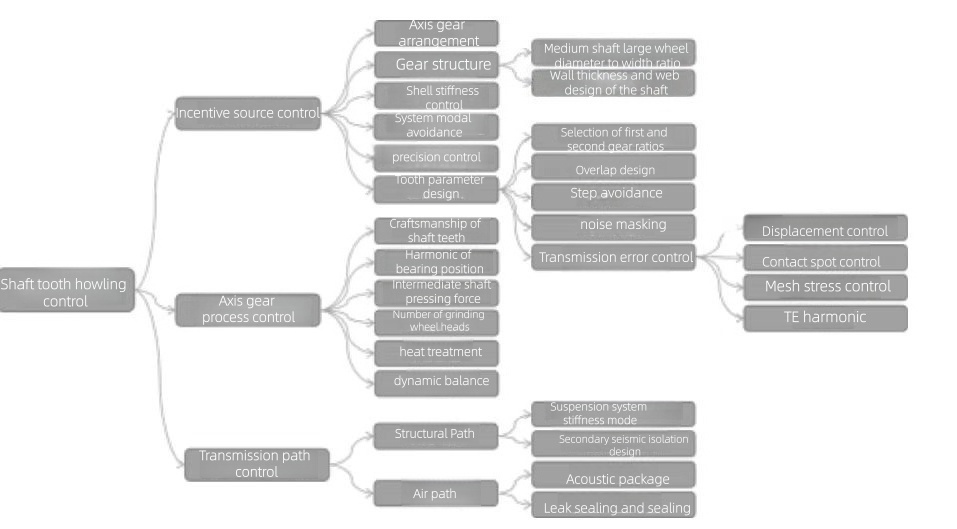

Gear NVH involves multiple aspects such as gears, electric drive, chassis, and the whole vehicle. It is a systematic control index with a wide range and great difficulty in control. At the beginning of the design, risks should be identified and controlled in advance from the dimensions of gear design & manufacturing and path.

In gear design, NVH of shaft gear involves many fields, such as gear design, machining, assembly, shell support stiffness, bearing stiffness, shaft gear mode, shell mode, electric drive mode, motor mode, transmission path, acoustic radiation, etc.

Figure 2: Axis-tooth squeal control points Source: Compiled from public data

In gear manufacturing, precision requirements are escalating. While the industry currently adheres to national standard grades 5-6, rising NVH (Noise, Vibration, and Harshness) demands now require specific gear precision metrics to exceed grade 4, posing significant challenges for both accuracy and consistency assurance. Given the lengthy processing cycle and multiple critical stages, stringent controls are essential across all phases—from material selection and blank production to heat treatment, finishing, and gear grinding. Each process requires precise parameter optimization, further complicating manufacturing. Comprehensive monitoring is imperative for NVH-critical parameters including tooth profile orientation, cumulative runout, surface roughness, Fourier analysis, tooth surface waviness, three-dimensional profile, dynamic balance, and grinding patterns.

The Development Status and Challenges of Bearing

High-speed requirements for bearings

▶ present situation

In 2024, the industry’s bearing requirements generally specify rotational speeds between 16,000 and 23,000 rpm, with some OEMs developing ultra-high-speed motors during pre-research stages that require 30,000 rpm. From the perspective of bearing usage across OEMs,imported brands dominate high-speed bearing applications, while domestic brands are rapidly catching up in both technological development and installation verification.

▶ throw down the gauntlet

Ultra-high-speed bearings with low friction and temperature rise, using special heat-treated steel balls or low-cost ceramic balls.

High-speed lightweight cage design to suppress the “umbrella effect” in pocket holes, along with the R&D and design simulation of specialized cage materials.

High-speed bearings require higher internal precision, such as roundness, ripple, roughness, profile, runout, etc.

time line

2015-2017

2018-2019

2020-2024

2025

2030

bearing dmN

800,000

1 million

1.5 million

180,000

2 million

Example of bearing rotational speed( unit rpm)

6208→13000

6208→16000

6208→25000

6208→30000

6208→33000

Table 3 Timeline for High-Speed Mass Production of Electrically Driven Bearings (dmN: a rotational speed parameter measured in mm·r/min)

The need for high efficiency in bearings

▶ present situation

Current electric drive systems predominantly utilize low-friction bearings. For instance, the XPeng XPower 800V electric drive platform employs industry-leading low-friction bearing designs throughout. To balance gearbox design redundancy and cost considerations, most intermediate and output shaft support bearings adopt tapered roller bearing combinations. For optimal operational efficiency, lower-friction deep groove ball bearings (DGBB) paired with cylindrical roller bearings (CRB), or dual-row ball bearings (TBB), would be more suitable.

▶ throw down the gauntlet

Cone roller bearings deliver lower friction loss through optimized flange convexity design, ultra-precision manufacturing, and nylon cage.

The bearing features miniaturization and custom design, utilizing high-purity steel with specialized heat treatment and coating reinforcement technologies.

Select the optimal bearing efficiency combination based on actual operating conditions, such as DGBB+CRB, TRB, or TBB.

Development demand of insulating bearing

▶ present situation

With the industry’s widespread adoption of 800V high-voltage platforms for electric drives, power modules in inverters have transitioned from IGBT to SiC, resulting in faster switching speeds. The high dv/dt (voltage-to-current rate) has dramatically increased the risk of electrical corrosion in bearings, demanding enhanced insulation protection. While hybrid ceramic ball bearings currently offer the most ideal insulation, their exorbitant manufacturing costs remain a major industry pain point. Meanwhile, low-cost insulated bushing bearings are being actively developed, with leading manufacturers including SKF, Ensk, Fuji Electric, and Renben.

▶ throw down the gauntlet

Development of low-cost ceramic ball bearings and localization of ceramic powder supply chain.

The insulation bushing bearing is developed with the target insulation impedance of 800Ω@1~5MHz.

time line

2018-2020

2021-2023

2024

2025 and beyond

voltage platform

800,000

1 million

1.5 million

180,000

motor bearings

ball bearing

hybrid ceramic ball bearing

The insulation layer has an impedance of 400Ω (1-5MHz).

The insulation layer has an impedance of 800Ω (1-5MHz).

Table 4 Voltage Platform and Bearing Selection Trend

Trends and Planning of Transmission System Assembly

The electric drive system is developing towards the multi-objective direction of compact size, low weight, high efficiency and low noise, which provides more space, higher endurance and more comfortable riding environment for the vehicle.

▶ Development Direction: Coaxial planetary gear technology aligns with the development objectives of electric drive systems and is emerging as the mainstream trend for future electric drive systems, particularly in high-torque electric drive products. To deliver high-performance experiences for users, planetary gears will gradually dominate the market. Both domestic OEMs and Tier1 manufacturers are actively investing in and developing this technology. Core components and processes of planetary gears, such as gear rings, planetary gear mechanisms, planetary carrier stamping, and welding, show significant growth potential.

To meet users’ demands for optimal handling and versatile power output across various scenarios, distributed electric drive systems (including central integrated distributed drive, wheel-side drive, and hub motors) along with multi-speed transmission systems are being deployed in specialized applications, significantly enhancing the user experience across diverse operating conditions and environments. Meanwhile, most small-torque electric drive systems continue to utilize parallel shaft transmission configurations, ensuring optimal cost-performance ratios for end-users.

▶ Supply Chain and Cooperation Model: With the country’s emphasis on the new energy vehicle industry, compared to the traditional transmission industry, the initial technical threshold and industrialization investment threshold for electric drive systems are both lower, further promoting the continuous development of China’s new energy electric drive system industry. From the initial dominance of the supply chain, it has gradually evolved into a dual-track approach of supply chain plus OEM self-developed and self-manufactured systems. As market competition intensifies and the integration level of electric drive systems continues to improve, the future supply chain will be more closely integrated with OEMs,with clear division of labor, to ensure long-term market stability.

Trends and objectives for high-efficiency transmission systems

With the continuous improvement of efficiency targets, technologies such as ultra-high-precision shaft teeth, low rolling resistance bearings, low oil agitation loss shaft arrangements, active lubricant dry oil pan systems, and ultra-low viscosity lubricants will be progressively adopted. Coupled with the widespread use of coaxial planetary gear reducers, the CLTC efficiency target for transmission systems is expected to exceed 98% by 2024.

Future efficiency gains will transcend isolated upgrades to components or sub-assemblies, focusing instead on system-level optimization and integrated multi-strategy applications. Efficiency metrics will become more granular, with automakers now prioritizing real-world performance metrics like 100km/h and 120km/h steady-state range—beyond the conventional CLTC (China Light-Duty Test Cycle) benchmark—to better align with users’ daily driving needs.

Figure 3 Efficiency levels of electric drive industry reducers in the past three years

The trend and objectives of lightweight design

From 2027 to 2030, planetary gear sets are expected to be widely adopted in high-power, high-torque electric drive systems, reducing weight by 30% to 40% compared to current standards. With advancements in new materials (e.g., magnesium-aluminum alloy housings) and manufacturing processes (such as welding differential bolts instead of screws, and stamping die-cast differential housings), the drive system weight is projected to decrease by an additional 5%.

time

2027-2030

torque output

<3000Nm

3000-4000Nm

4000-5000Nm

Weight (dry weight)

<15kg

15-18kg

18-25kg

Table 5 Relationship between Transmission System Weight and Torque Output

Trend and goal of low-noise transmission system

To meet users’ increasingly stringent comfort requirements, the transmission system has progressively enhanced its excitation optimization and path simulation capabilities, with NVH targets varying across different vehicle classes.

Alongside advancements in simulation techniques, NVH research has shifted focus toward user-critical driving conditions. The initial development emphasis has transitioned from 100% torque NVH performance to real-world scenarios like light throttle and steady-state driving.

NVH issues are inherently systemic challenges. As user demands grow, solutions for electric drive NVH problems are evolving from isolated fixes to comprehensive system-level approaches, balancing cost-effectiveness. This includes strategies like noise masking for gear stage background noise, localized acoustic packaging, and frequency-specific optimization of acoustic materials. With continuous advancements in transmission reducer component manufacturing, noise levels in drive systems are progressively decreasing.

The noise standard of the transmission system is 1.5 m average noise, and the target trend prediction is shown in the table below.

Noise of Half-Load Bench at Full Torque Condition

time

2024-2027

2027-2030

Low-end model

70dB(A)

68dB(A)

Mid-to-high-end car models

65dB(A)

60dB(A)

Table 6: Average Noise Trends

Trends and targets of spatial dimensions

In order to meet the demand of larger interior space and platform layout of powertrain, the powertrain is required to be compact and regular in shape, and the transmission is gradually developing from parallel shaft to planetary coaxial arrangement.

The planetary arrangement offers superior spatial dimensions, particularly in the X-axis direction compared to parallel-axis configurations. With equivalent output capacity, the X-axis configuration can reduce the space requirement by approximately 40%.

Axis Gear Trends and Goals

To meet the development of new energy vehicles, the performance requirements for gears are becoming increasingly stringent.

▶ Lightweighting: With the development of new energy vehicles towards lightweight, gears and transmission systems are also optimized towards smaller volume and lighter mass; structural innovation, small center distance gears and planetary gear reducer configurations have become the industry development trend.

▶ High-efficiency transmission: To improve the range and overall energy efficiency of new energy vehicles, high-efficiency gears and transmission systems are continuously optimized in terms of conversion efficiency, transmission ratio, and torque density. High-speed and high-ratio gears are becoming the trend.

▶ High NVH performance requirements: Noise control is critical to the ride comfort of new energy vehicles. High NVH performance gears have become a key control indicator in the development of new energy vehicle gears. The design dimension is controlled in advance, involving multi-dimensional design control such as gear structure, machining, assembly, housing support stiffness, bearing stiffness, shaft-to-tooth modal, housing modal, electric drive modal, motor modal, order avoidance, transmission path, and acoustic radiation.

▶ Materials and Manufacturing: High-performance materials including high-strength steels, advanced alloys, non-metallics, and composites are being progressively adopted. The precision requirements for gears are increasingly stringent, with national standards mandating Grade 5 or higher precision, and some parameters reaching Grade 4 or higher. A comprehensive control system integrates human, machine, material, method, and environmental factors in gear manufacturing. Strict coordination across all machining processes ensures full sequence precision. The implementation of new technologies such as honing, ultra-finishing grinding, and precision gear manufacturing enhances accuracy while maintaining consistency.

▶ Because of the tooth tolerance, gear machining error, assembly error, etc., the gear has other order besides the characteristic order, so the control of gear precision is very important.