1.1 Working Principle and Main Classification of Reducer In mechanical transmission systems, a reducer functions as a critical intermediate device connecting the power source and actuator. Its core mechanism involves gear reduction and torque amplification through mechanical transmission. Specifically, the reducer employs a gear system where the input shaft (with fewer teeth) meshes with the output shaft’s larger gear, effectively decelerating the high-speed rotational force of the prime mover while increasing the output torque. As a result, reducers are extensively utilized in low-speed, high-torque transmission equipment and are considered a key factor influencing robotic performance. Reducers come in diverse types and models to meet the varying power transmission needs across industries. They can be classified in multiple ways. Based on control precision, reducers are categorized into general-purpose reducers and precision reducers. General-purpose reducers offer lower control precision but suffice for basic power transmission in general machinery. Precision reducers, on the other hand, feature high accuracy, extended service life, minimal backlash, and superior reliability, making them ideal for high-precision control applications in industrial robotics, collaborative robotics, industrial automation, and other advanced manufacturing fields. Precision reducers, primarily RV reducers and harmonic reducers, are core components in high-end equipment manufacturing such as robotics, accounting for approximately 35% of the total cost of an industrial robot. These reducers are widely used in high-precision control applications including industrial robots, collaborative robots, and industrial automation, where they face high technical barriers. Specifically, harmonic reducers are designed for lightweight, low-load applications, while RV reducers are optimized for medium-to-high load scenarios requiring high torque and rigidity. The latter demands more advanced technology, presents greater challenges in production and assembly, and has a lower domestic production rate. Currently, Japan’s Nabtesco maintains a leading position in this global market. Due to their distinct technical characteristics in transmission principles and structural designs, these two systems demonstrate complementary advantages in downstream products and application domains, serving diverse scenarios and end-use industries. A concrete comparison in industrial robotics is as follows:

project

RV decelerator

harmonic reducer

Transmission principle and deceleration structure

The reducer is composed of the first stage involute planetary transmission and the second stage cycloidal planetary transmission. At least two eccentric shafts are used to connect the second stage reducer. The pinion and cycloidal gear are made of solid castings and steel parts.

The system is composed of three core parts: the flexible wheel, the rigid wheel and the wave generator. It is simple and compact, and the material, volume and weight are lower than the RV reducer.

performance characteristics

Large volume, high load capacity (allowable torque load can reach 28,000 N·m), high stiffness; but at the same time, the product uses relatively complex over-positioning structure, manufacturing process and cost control is more difficult

The volume is small and the load is low (the allowable torque load is up to 1,500 N·m), but the key gear is a flexible element, and its performance is gradually reduced under repeated deformation, and the bearing capacity and life of the product are limited.

load bearing capacity and life

The product can achieve higher product torque and anti-impact ability, torsional overturning stiffness, fatigue strength is greater, precision life is longer, high motion precision.

The flexible gear transmission has low fatigue life and weak torsion resistance.

synovial joint

It is more suitable for large torque and heavy load joints such as robot base, waist and upper arm.

It is generally used for light load positions such as forearm, wrist and hand.

Actual usage

RV reducers are primarily used for loads above 20kg, while RV harmonic reducers are recommended for loads between 6kg and 20kg.

For loads under 6kg, harmonic reducers are typically used.

Main terminal application areas

The field of medium and heavy-duty robots, represented by industries such as automotive, photovoltaic, welding, bending, spraying, palletizing, metal processing, transportation, and port terminals.

The 3C electronics, semiconductor, food, injection molding, mold, and medical industries are in high demand for light-duty robots.

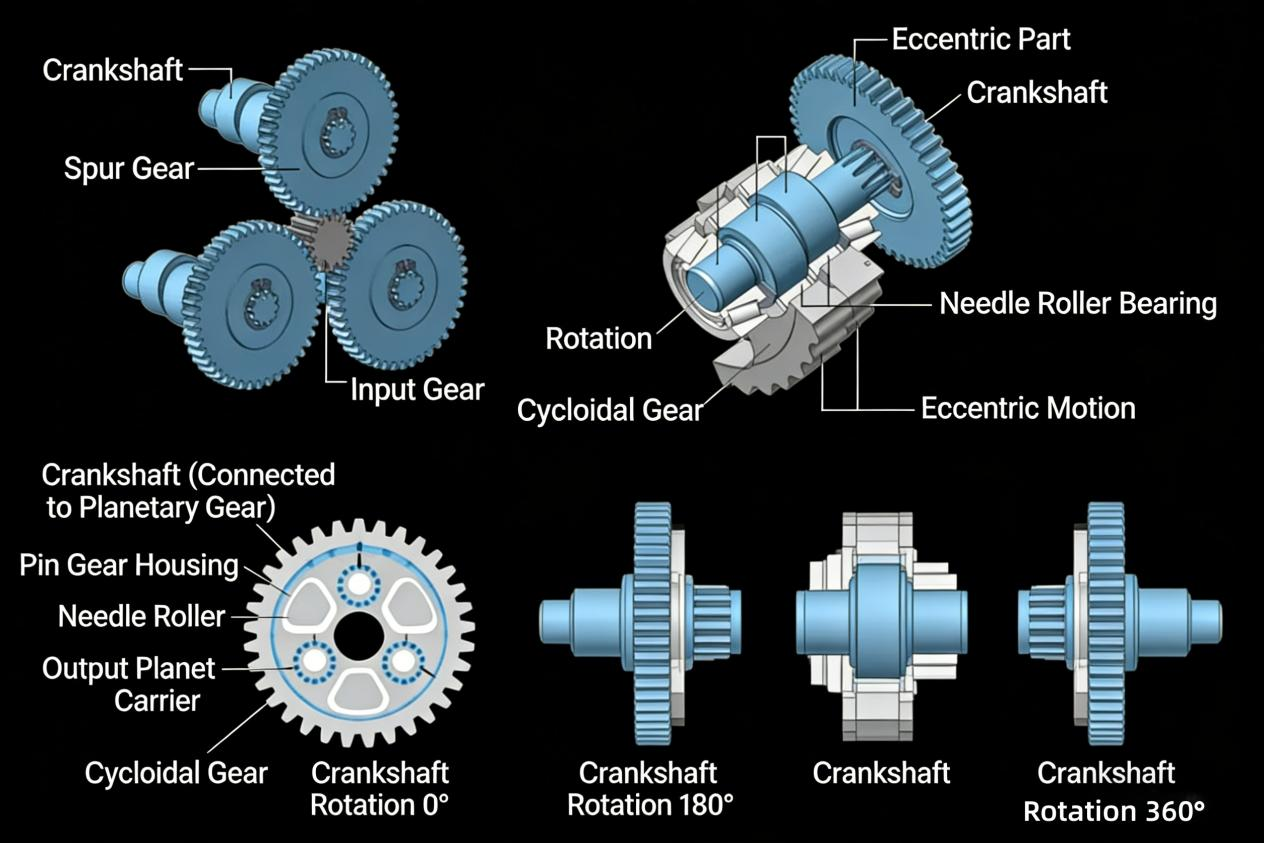

1.2 Working Principle and Characteristics of RV Reducer As defined in GB/T 34897-2017 “Precision Bearings for RV Reducers in Rolling Bearing Industrial Robots”, an RV reducer is a transmission mechanism comprising a planetary gear reducer as the front stage and a cycloidal pinwheel reducer as the rear stage. It features a high transmission ratio and self-locking capability under specific conditions. The RV reducer, developed from traditional pin-torsion planetary transmission, features a dual-stage reduction system comprising a planetary gear reducer as the front stage and a cycloidal pinwheel reducer as the rear stage, with at least two eccentric shafts connecting the two stages. Its housing and cycloidal pinwheel are solidly coupled through castings and steel components, forming a closed differential gear train. This innovation not only overcomes the limitations of conventional cycloidal pinwheel transmissions but also delivers a range of advantages including high precision (with tooth clearance below 1 arc minute), exceptional rigidity, superior durability, high output density (compact yet powerful), a broad speed reduction ratio, and minimal vibration. The motion transmission process of the RV reducer operates as follows: The servo motor’s rotation is transmitted to the planetary gears through the input gear. Based on the gear ratio between the input gear and the planetary gears, the speed is correspondingly reduced (first-stage reduction). The crankshaft is directly connected to the planetary gears, maintaining the same rotational speed. Two cycloidal gears are installed between the eccentric section of the crankshaft and the needle roller bearings. When the crankshaft rotates, the cycloidal gears mounted on the eccentric section also perform eccentric motion around the input shaft. On the other hand, the needle roller housing contains needle rollers evenly spaced at intervals, with one additional roller per cycloidal gear. As the crankshaft completes one full rotation, the cycloidal gears engage with the needle rollers while undergoing eccentric motion. During this process, the output planetary carrier rotates one tooth’s distance in the opposite direction to the crankshaft’s rotation. This rotation is then transmitted to the shaft of the second-stage reduction unit (second-stage reduction). The total reduction ratio is the product of the reduction ratios from both first and second stages.

The situation of precision reducer industry in China

2.1 The successive introduction of national strategies and industrial policies has driven the rapid development of domestic precision reducers. In recent years, industrial policies have provided strong support for technological breakthroughs and accelerated development in industrial robots and precision reducers. The government has designated robotics and high-end CNC machine tools as one of the ten key priority areas requiring vigorous promotion, with specific requirements to achieve engineering breakthroughs and industrialization of intelligent core components like reducers. The 14th Five-Year Plan and its supporting plans outline strategies to deepen the manufacturing power strategy, optimize and upgrade the manufacturing sector, cultivate advanced manufacturing clusters, and drive innovation in industries such as robotics. The plan emphasizes the development of intelligent manufacturing equipment, addressing weaknesses in perception, control, decision-making, and execution through industry-academia-research collaboration. Key objectives include overcoming critical bottlenecks in foundational components and devices, as well as developing advanced controllers, high-precision servo drive systems, and high-performance, high-reliability reducers. For instance, the “14th Five-Year Plan for Robot Industry Development” outlines that in the face of new circumstances and requirements, the next five years and beyond will be a strategic opportunity period for China’s robotics industry to achieve self-reliance, innovation, and leapfrog development. It emphasizes seizing opportunities, confronting challenges, and accelerating solutions to issues such as insufficient technological accumulation, weak industrial foundations, and lack of high-end supply, thereby propelling the robotics industry toward mid-to-high-end development. The plan advocates for high-end and intelligent development, targeting industrial transformation and consumption upgrades. Key priorities include breaking through core technologies, consolidating industrial foundations, enhancing effective supply, expanding market applications, improving supply chain stability and competitiveness, continuously refining the industrial ecosystem, and driving high-quality growth in the robotics sector. The development goals set forth in the plan are: By 2025, China aims to become a global hub for robotics innovation, a cluster for high-end manufacturing, and a new frontier for integrated applications. Breakthroughs will be achieved in core robotics technologies and premium products, with overall performance metrics reaching international advanced levels and key components matching the reliability of global counterparts. The robotics industry’s annual revenue growth rate will exceed 20%, fostering a group of internationally competitive leading enterprises and numerous innovative, high-growth specialized “little giant” enterprises. Three to five globally influential industrial clusters will be established. Manufacturing robot density will double. By 2035, China’s robotics industry will achieve world-leading comprehensive strength, with robots becoming integral components of economic development, people’s livelihoods, and social governance. The plan outlines key objectives: strengthening industrial foundations, enhancing the functionality, performance, and reliability of critical robot components, and developing advanced manufacturing technologies for high-performance reducers, including RV reducers and harmonic reducers. These efforts will improve precision retention (longer lifespan), reliability, and noise reduction, paving the way for mass production. The successive rollout of national and industrial policies has provided strong support for the rapid development of domestic precision reducers. 2.2 Benefiting from the growing demand for industrial robots, the market for industrial robot reducers, including RV reducers, is expanding rapidly. According to GGII data, China’s total demand for industrial robot reducers increased from 931,100 units to 1,366,000 units between 2021 and 2024, with a compound annual growth rate (CAGR) of 13.63%. The incremental demand rose from 824,100 units to 1,154,500 units, achieving a CAGR of 11.89%. As digitalization accelerates, the automation of human labor will gain significant benefits. As a core component driving industrial automation, supporting industrial upgrading and smart manufacturing, reducers are poised for long-term growth. 图片4

2.3 The Rise of Domestic Brands in Industrial Robots and RV Reducers In recent years, driven by surging downstream demand, expanding application fields, and bolstered by industrial policies and collaborative efforts among government, industry, academia, research institutions, and end-users, China’s industrial robotics sector has prioritized breakthroughs in core technologies. Domestic manufacturers have consistently overcome technical hurdles in critical components like gearboxes, steadily enhancing their technological prowess and competitive edge. The performance gap between Chinese products and global leaders continues to narrow. In China’s industrial robot market, domestic brands are rapidly rising, and the import substitution process is accelerating. With breakthroughs in key technologies, improvements in the performance of domestic robots, and the optimization of the supply chain system, domestic industrial robot manufacturers have seized market opportunities to achieve rapid growth in recent years. Meanwhile, China’s industrial robot reducer industry, including RV reducers, has entered a phase of rapid growth. With domestic RV reducer manufacturers enhancing their technical capabilities and product performance, gradually expanding production capacity, and gaining increasingly prominent pricing and cost-performance advantages, leading domestic industrial robot manufacturers are rapidly increasing the localization rate of RV reducers in procurement. This trend is driven by considerations such as supply chain security and stability, procurement costs, and procurement cycles. The domestic industrial robot reducer market demonstrates significant growth potential and vast market space.

Industry technical level and characteristics

The RV reducer industry is characterized by high technical difficulty, high investment threshold, and high industry barriers. It requires substantial capital and talent investment in R&D design, quality control, product testing, assembly, and trial verification. The manufacturing process imposes strict requirements on materials, production equipment, and process precision. This industry is a technology-intensive, capital-intensive, and talent-intensive sector. The key technical parameters of industrial robot RV reducers include torsional stiffness, starting torque, transmission accuracy, backlash, clearance, transmission error, transmission efficiency, and noise. The design, development, and manufacturing of RV reducers require repeated testing and adjustments of related materials, component structures, and gear profiles, a process demanding 5-6 years of technical expertise and experience. The precision requirements of RV reducers determine their high technical content in production. Major technical challenges include their two-stage reduction design, where even minor errors at the front end are amplified during output, affecting product accuracy. Additionally, to ensure transmission of high torque, withstand significant overload impacts, and maintain expected service life, RV reducers employ over-positioning structures in their design. This necessitates high-precision machining and presents substantial processing difficulties. Particularly during mass production, achieving stability, reliability, and consistency in product performance and quality becomes even more challenging. In recent years, supported by industrial policies and collaborative efforts among government, industry, academia, research institutions, and users, China’s robotics R&D has prioritized breakthroughs in core technologies. Through years of independent innovation and technology absorption, some domestic enterprises have successfully overcome technical challenges in key components like reducers, steadily enhancing their technological capabilities and core competitiveness. Their products now meet internationally advanced standards in technical specifications and performance. Particularly in industrial robotics, manufacturers like Huan Dong Technology, a leading RV reducer producer, have filled the supply-demand gap for core components in China’s industrial robotics sector through sustained independent R&D and investment.

The main barriers to entering the industry

4.1 Barriers to Advanced Manufacturing Technologies The RV reducer industry is a technology-intensive, R&D-driven sector where product development and innovation demand robust technical capabilities and dedicated R&D resources. The entire lifecycle of an RV reducer—from design and development to mass production—requires years of iterative testing, refinement, and the accumulation of technical expertise. Given the industry’s broad application scope, leading players have developed advanced R&D and process design capabilities, along with extensive technical knowledge and experience. They can precisely identify industry trends, stay ahead of technological advancements, and effectively address product iteration needs. New entrants, however, often struggle to meet market demands in areas like technical expertise and talent development, making it difficult for them to achieve significant breakthroughs quickly and putting them at a competitive disadvantage. 4.2 Customer Access Barriers For downstream industry clients, the performance and quality of RV reducers directly impact the quality and other characteristics of host products. When selecting RV reducer manufacturers, downstream clients maintain a rigorous supplier qualification system. Industry manufacturers must not only pass internationally recognized quality system certifications but also meet the evaluation criteria established by individual clients. The supplier selection process typically involves extended periods of stringent audits and product performance assessments. Clients generally test suppliers’ products on multiple performance metrics including precision, reduction ratios, load capacity, transmission efficiency, service life, and stability, with some clients conducting tests lasting tens of thousands of hours. For these clients, once a supplier enters their network, stable partnerships are typically established. Consequently, the RV reducer industry maintains certain customer entry barriers. 4.3 Barriers to Capital Investment and Large-Scale Production RV reducers demand high performance standards and advanced manufacturing processes, involving multiple production stages, diverse raw material requirements, and a significant need for high-performance materials. They also require comprehensive accessory kits. Meanwhile, customers increasingly demand extended delivery cycles and expanded product ranges to meet their varied application scenarios. To address these needs, RV reducer manufacturers must develop multi-variety, large-scale production capabilities. This requires substantial capital investment, technical expertise, and operational experience in equipment procurement, production scaling, and process control to establish competitive advantages. On one hand, companies must invest heavily in precision machining and testing equipment, which demands high-end machinery often imported or custom-made. These systems face prolonged delivery and installation periods with costly maintenance. On the other hand, ensuring product reliability and stability necessitates standardized production protocols, real-time monitoring, and multi-stage quality checks. Consequently, new entrants to the industry struggle to achieve mass production capabilities within short timeframes.

Trends in the industry

5.1 Import substitution accelerates, domestic manufacturers welcome rapid development opportunities Currently, mainstream international brands still dominate the global RV reducer market, with high sales prices and expensive after-sales maintenance costs. This situation has somewhat hindered the development of domestic robot manufacturers. With the implementation of industrial incentive policies such as the “14th Five-Year Plan for Intelligent Manufacturing Development” and the “14th Five-Year Plan for Robot Industry Development,” the manufacturing of intelligent key basic components has become a crucial industry for national technological breakthroughs. Meanwhile, through technological breakthroughs and process improvements, some domestic enterprises have achieved world-leading standards in performance and stability. With superior cost-effectiveness and localized service advantages, domestic brands continue to expand their market share while accelerating import substitution. Looking ahead, as China advances in theoretical research, manufacturing, and testing equipment development, and gains technical expertise in materials, precision machining of key components, and complete assembly processes, domestic brands will increasingly earn recognition from downstream clients. 5.2 The pace of industry standard development has accelerated, with significant improvements in product technology levels. Industry standards serve as regulatory frameworks that standardize practices, drive innovation, and guide sector development. By continuously refining standardization processes and accelerating the development of updated specifications, these standards enhance operational efficiency within the industry. The reducer market features diverse specifications, yet current industry standards exhibit delayed updates and incomplete coverage. Particularly for high-end precision RV reducers, existing standards remain out of sync with global benchmarks, hindering the industry’s rapid evolution. As intelligent transformation accelerates, the development of industry standards will increasingly align with technological advancements, product innovations, and manufacturing processes. Moving forward, industry standards will adopt a holistic approach covering the entire reducer supply chain. This comprehensive strategy will guide RV reducer manufacturers toward achieving higher and more consistent technical standards, ultimately improving mechanical precision, service life, operational stability, and reliability in the RV reducer sector. 5.3 Downstream applications are extensive, with long-term positive industry trends RV reducers demonstrate extensive downstream applications, with industrial automation being a key sector alongside robotics. As technological advancements and industrial automation levels continue to rise, these reducers are poised to expand their applications across more fields, driving diversified downstream demand. Furthermore, fueled by sustained national economic growth and supportive industrial policies, China’s fixed asset investment has shown consistent annual increases. Multiple downstream sectors are witnessing promising development prospects propelled by economic expansion and industrial investments. The market demand and industry scale for RV reducers are projected to maintain a positive long-term growth trajectory.

Opportunities and Risks for Industry Development

6.1 Opportunities Facing the Industry 6.1.1 Strong support and guidance from industrial policies The RV reducer industry is a key sector in China’s advanced manufacturing sector, supported by national industrial policies. Relevant authorities have rolled out a series of development plans, including the “Implementation Opinions on Enhancing Manufacturing Reliability,” “14th Five-Year Plan for the General Machinery Components Industry,” “14th Five-Year Plan for Intelligent Manufacturing,” “14th Five-Year Plan for Robot Industry Development,” “National Intelligent Manufacturing Standards System Construction Guide (2021 Edition),” and “Guiding Opinions on Promoting Robot Industry Development.” These initiatives have created a favorable environment for the industry’s growth. As a core component of high-precision reducers and industrial robots, RV reducers continue to receive sustained policy support. For instance, the “14th Five-Year Plan for Robot Industry Development” jointly issued by the Ministry of Industry and Information Technology (MIIT) and 15 other departments proposes to “develop advanced manufacturing technologies and processes for RV reducers and harmonic reducers, enhancing their precision retention (service life), reliability, and noise reduction for mass production.” Similarly, the “14th Five-Year Plan for Intelligent Manufacturing Development” released by MIIT and seven other departments lists “high-performance, high-reliability reducers” as a critical category requiring breakthroughs in bottleneck foundational components and devices. In 2023, the National Development and Reform Commission (NDRC) published the “Industrial Structure Adjustment Guidance Catalog (2024 Edition),” which included “high-precision industrial robot reducers” and “robot-specific high-precision reducers” in its encouraged category. The introduction of a series of encouraging and supporting policies by the state has laid a good policy foundation for the development of this industry, and provided a broad industrial policy space and opportunities for the sustained and rapid development of the industry. 6.1.2 The downstream industry continues to develop RV reducers are extensively utilized in high-precision control applications such as robotics and industrial automation. China has emerged as the world’s largest market for industrial robots, accounting for approximately 50% of global demand, which has become a powerful growth engine for the industry. The government will continue to drive intelligent manufacturing transformation, deepen the integration of industrialization and informatization, and enhance industrial automation capabilities to accelerate the development of industrial robots, particularly in three core components: reducers, controllers, and servo systems. Meanwhile, the expanding application sectors and market growth will further expand the RV reducer industry’s market potential. The medium-to-long-term outlook for this sector remains positive, presenting significant development opportunities. 6.1.3 Domestication Requirements for Key Components As critical components in high-end equipment such as robots and CNC machine tools, RV reducers are indispensable in industrial automation and intelligentization, playing a vital role in manufacturing transformation and upgrading. With growing demand for RV reducers in industrial robots, China has faced persistent shortages of core components. The industry once heavily relied on imported international brands for RV reducer production, severely constraining capacity expansion for domestic downstream manufacturers. To accelerate downstream industry development, it is imperative to advance RV reducer technology, alleviating production constraints on robot manufacturers and laying the foundation for smart manufacturing to drive economic growth and industrial transformation. Currently, some domestic RV reducer enterprises have overcome technical bottlenecks and achieved breakthroughs. For domestic downstream manufacturers, the maturation of these key components not only reduces production costs but also unlocks new production capacity. 6.2 Risks Faced by the Industry 6.2.1 The technical and technological capabilities of domestic enterprises are still insufficient. International manufacturers have maintained a clear first-mover advantage. For decades, China’s RV reducer technology lagged behind developed nations, with global market dominance held by foreign brands. Japan’s Nabtesco remains the top domestic producer, while China still heavily relies on imported key components for industrial robots. In recent years, domestic manufacturers like the company have achieved breakthroughs through continuous R&D efforts. Their products are now gaining recognition from downstream industries, breaking the technological monopoly of foreign brands. However, domestic RV reducers still fall short of imported counterparts in precision, durability, stability, and consistency. Common issues include limited product variety and insufficient size options. To compete, domestic manufacturers must increase investment to develop upgraded models for diverse applications. The industry’s growth requires Chinese brands to enhance R&D capabilities, refine manufacturing processes, and expand product portfolios. By building trust through reliable performance, competitive pricing, and localized services, domestic RV reducers can secure a stronger market position. 6.2.2 Limited capacity for large-scale production Compared to international RV reducer giants, domestic manufacturers generally operate on a smaller scale with weaker financial strength, which hinders long-term development. Although policy support has led to the emergence of domestic enterprises with mass production capabilities in recent years, the gap with global industry leaders remains substantial. Most domestic RV reducer manufacturers still face constraints from limited production capacity. While the growing market demand from downstream industries provides an objective foundation for rapid expansion, it also imposes higher requirements on production scale and financial strength. Domestic manufacturers are now facing unprecedented challenges in scaling up production capabilities.

Cyclical, regional or seasonal characteristics of the industry

The RV reducer industry shows no distinct cyclical or seasonal patterns, primarily driven by macroeconomic policies and downstream market demand. Domestic players are predominantly based in East and North China, serving clients across these regions, while international competitors are mainly concentrated in Japan.

The position and role of the industry in the industrial chain

The RV reducer industry occupies the midstream of the industrial chain. Its upstream consists of suppliers of raw materials and production equipment, including bearings, blanks, steel, cutting tools, and measuring instruments. The downstream primarily applies to high-end manufacturing sectors such as robotics and industrial automation. The upstream industry’s production capacity, delivery quality, and technological standards directly influence the quality and scale of raw material supply for the RV reducer sector. Meanwhile, as RV reducer manufacturers enhance product quality and production processes, their rigorous selection, evaluation, and material verification of upstream suppliers also drive and foster technological advancements among these suppliers. The downstream sector, a high-end manufacturing field prioritized by national industrial policies for intelligent and automated development, has witnessed significant demand growth in recent years. As a core component of downstream products like industrial robots, the RV reducer’s performance, precision, and quality stability critically influence the functionality of downstream host products, making it a pivotal contributor to the advancement of downstream industries.

The relevance between the industry and its upstream and downstream sectors

9.1 Relevance to the upstream industry The primary raw materials for RV reducers include externally sourced components such as bearings, blanks, steel, and cutting tools. The upstream supply chains for bearings, blanks, and steel are predominantly sourced from the steel industry, where market supply remains abundant and competition is intense. Both product quality and supply conditions meet industry demands. In recent years, steel prices have remained relatively stable due to supply-side reforms and overcapacity reduction efforts in the steel sector. However, fluctuations in steel prices—driven by factors like international commodity market trends—may affect the raw material costs and profit margins of reducer products. From a long-term perspective, China’s ample steel supply is unlikely to adversely impact the RV reducer industry. 9.2 Relevance to Downstream Industries As an indispensable component in high-precision equipment, RV reducers are extensively utilized in advanced manufacturing sectors like robotics and industrial automation. Their product quality, reliability, and service life directly determine the performance of host systems, while the industry’s scale and development trends are driven by downstream market demands. In recent years, with the introduction of supportive policies such as the “14th Five-Year Plan for the General Machinery Parts Industry” and the “14th Five-Year Plan for Robot Industry Development,” high-end equipment manufacturing—represented by industrial robots and high-end CNC machine tools—has become a key focus for national development to achieve breakthroughs. Meanwhile, the accelerated industrial restructuring and upgrading have spurred continuous advancements in industrial automation and intelligentization. Benefiting from downstream industry momentum, the RV reducer sector is poised to enter a new phase of rapid growth.

Industry competition landscape

In the context of Industry 4.0, developed countries represented by Japan have prioritized advancing the robotics industry. They have achieved complete self-sufficiency in core components like RV reducers and secured significant market share through technological leadership. The RV reducer industry is characterized by high technical complexity, substantial investment thresholds, and stringent industry barriers. It requires substantial capital and talent investment in R&D design, quality control, and product testing. Manufacturing processes demand strict requirements for materials, production equipment, and process precision, making large-scale production challenging. Globally, few manufacturers can reliably supply mass-produced RV reducers with reliable performance. Leveraging their long history, strong capital base, and extensive technical expertise, Japanese companies dominate the global industrial robot reducer market. Notable representatives include Nabtesco, which has established a prominent position through cutting-edge R&D capabilities, large-scale production capacity, consistent product quality, and long-standing collaborations with international industry leaders like FANUC and KUKA. Due to the late start of China’s RV reducer industry, the overall technical level of enterprises in the industry still lags behind that of internationally leading companies. In the domestic RV reducer market, as domestic manufacturers continuously overcome technical challenges, their technical capabilities and competitiveness have steadily improved, narrowing the gap between product performance and the leading levels abroad. According to the “China Robot Industry Development Report (2022)” by the China Electronics Society, the core competitiveness of key components in China’s industrial robots continues to rise. Taking reducers as an example, a group of outstanding enterprises such as Lüde Harmonic (mainly focusing on harmonic reducers) and Huandong Technology (mainly focusing on RV reducers) have become pioneers in leading the development of the domestic reducer market, thanks to their sustained R&D investment, high precision manufacturing capabilities, strict quality control, and continuously improving product systems.

Major companies in the industry

Globally, Nabtesco is the market leader in the RV reducer industry. In China’s RV reducer market, besides Nabtesco, Huandong Technology has gained a leading position with a market share approaching 20%, while other companies are relatively smaller. The basic situation is as follows:

corporate name

Headquarters location

Key business operations and market position

Nabtesco

Japan

As the creator of RV reducers and a leading enterprise in the field of motion control, it is the world’s largest manufacturer of robotic RV reducers. According to GGII statistics, its market share in China’s robotic RV reducers was 50.87%,40.17%, and 33.79% in 2022,2023, and 2024 respectively.

Circulation Technology

China

The main product, RV reducer, has basically covered leading domestic robot customers, with strong production and processing capabilities, enjoying high brand awareness in the industry. It has become a professional manufacturer of RV reducers for industrial robots with leading domestic production and sales volume. According to GGII statistics, its market share in China’s robot RV reducer market was 13.65%,18.89%, and 24.98% in 2022,2023, and 2024 respectively.

Source: publicly available data, GGII In recent years, Shuanghuan Technology has achieved rapid market expansion and established dominance in China’s robotics sector through its RV reducers. In 2020, Nabtesco dominated the domestic RV reducer market with 54.80% share, while Sumitomo Heavy Industries held 6.60% and Shuanghuan Technology only 5.25%. From 2021 to 2024, Shuanghuan Technology’s market share rose steadily to 10.11%,13.65%,18.89%, and 24.98%, consistently ranking second only to Nabtesco. During the same period, Nabtesco’s market share declined to 51.77%,50.87%,40.17%, and 33.79%, while Sumitomo Heavy Industries saw its share drop to 5.06%,4.70%,3.91%, and 3.58%. This sustained decline in international competitors’ market share highlights Shuanghuan Technology’s role as a leading domestic alternative to Nabtesco’s products. By progressively replacing imported Nabtesco components, Shuanghuan Technology has solidified its position as the industry leader in China’s robotics RV reducer market. 图片5 [Disclaimer]This excerpt is from Shuanghuan Technology’s prospectus. All rights reserved by the original author. For knowledge sharing and communication purposes only, not for commercial use. We maintain neutrality regarding all viewpoints expressed herein. Should you find any discrepancies between the cited sources and facts, or if there are copyright-related issues, please notify us for prompt revision or removal.